A recent study and survey – both done by WalletHub – illustrate the varying tax rates across the nation, the varying rates within states, and how people feel about their state’s taxes.

As for Illinois, the information is interesting in that the range of tax rankings ranges so dramatically across the spectrum: On the one hand, it is 51st in overall effective State & Local tax rate – meaning it is number one in this category – and 50th in Real-Estate tax – good for number two in the country; income tax ranks in at 39th as well – certainly above the national average.

Yet, on the other hand, it is exactly average as it concerns Sales & Excise taxes, and it is – conversely – the lowest in the nation as it concerns Vehicle Property tax.

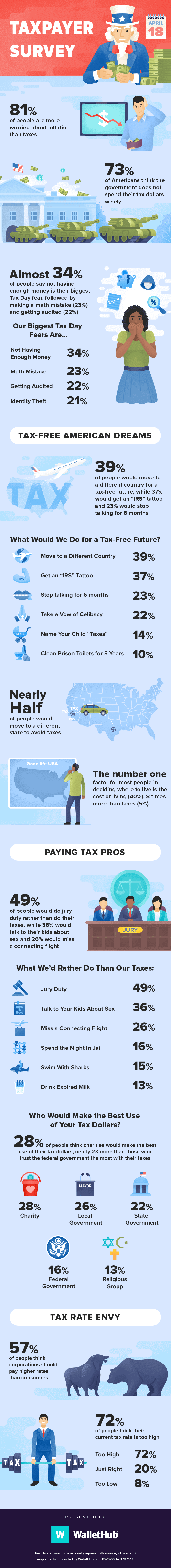

For a more in-depth look at the study, how all the states break down – or how people in Illinois feel about their taxes and how their tax money is spent by the state – graphics and resources can be found above in links and below in pictures!